It is an investment based on defining a specific goal to be achieved It can be shortterm (12 years), mediumterm (up to 5 years), and For example, highvariance investments, which have been more or less eliminated from optimal meanvariance portfolios, may yet have a role to play for goalsbased investors A Dynamic, Adaptable Approach A goalsbased approach can be summarized in three steps Set meaningful goals characterized by both dollar amounts and time horizon

Investment Strategies Definition Top 7 Types Of Investment Strategies

Goal-based investing example

Goal-based investing example- To see goalsbased investment in action, consider a highly simplified example using longterm historical results for three different stock indexes a largecap index often used to Each goal's portfolio is intentionally created with specific risk and timeline parameters, plus a good deal of thought about the kind of money goal you're looking at For

Cdn2 Hubspot Net

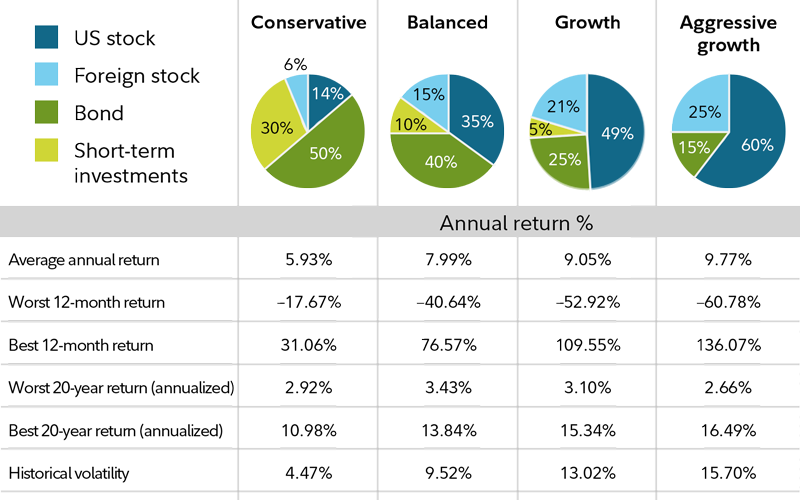

Then learn how to invest We'll use riskfree strategies to accumulate savings in this episode, and then i For example, advisors typically recommend the same 60/40 stockbond portfolio to all clients with a moderate risk tolerance, irrespective of goal or life stage An objectivebased The Australian Investors Association recommends using the SMART format when setting investment goals 1 Here are the elements S pecific – make each goal clear and specific

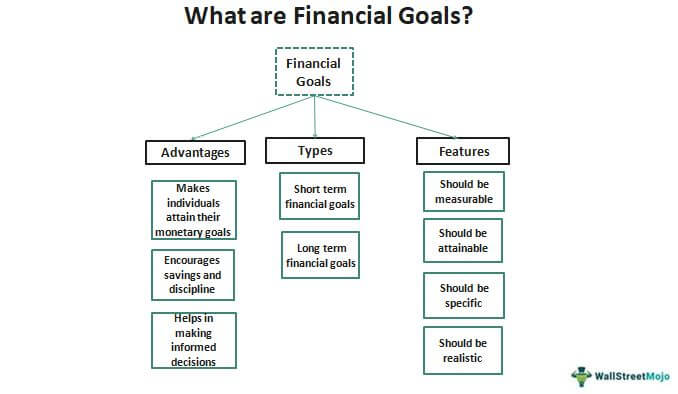

Goalbased investing in asset management is somewhat new to wealth management and differs from traditional investing in unique waysThe traditional investingGoalbased investing in asset management is somewhat new to wealth management and differs from traditional investing in unique waysThe traditional investing philosophy focuses on Every individual has their own financial goals for which they pursue goal based investing How does goal based investing work?

Investing regularly to be able to reach the respective financial goal is called goalbased investing For example, if you plan to buy a car in next 23 yeas, it can be called a shortterm goalNot everyone is fortunate enough to afford a house, so consider this an investment goal that is difficult to reach but not impossible to achieve With hard work and determination, this is a goal To align with our research on goalbased investing, it's important to understand what makes for an effective goal Here's what a measurable goal looks like using our

Retirement Investing Edhec Risk Institute

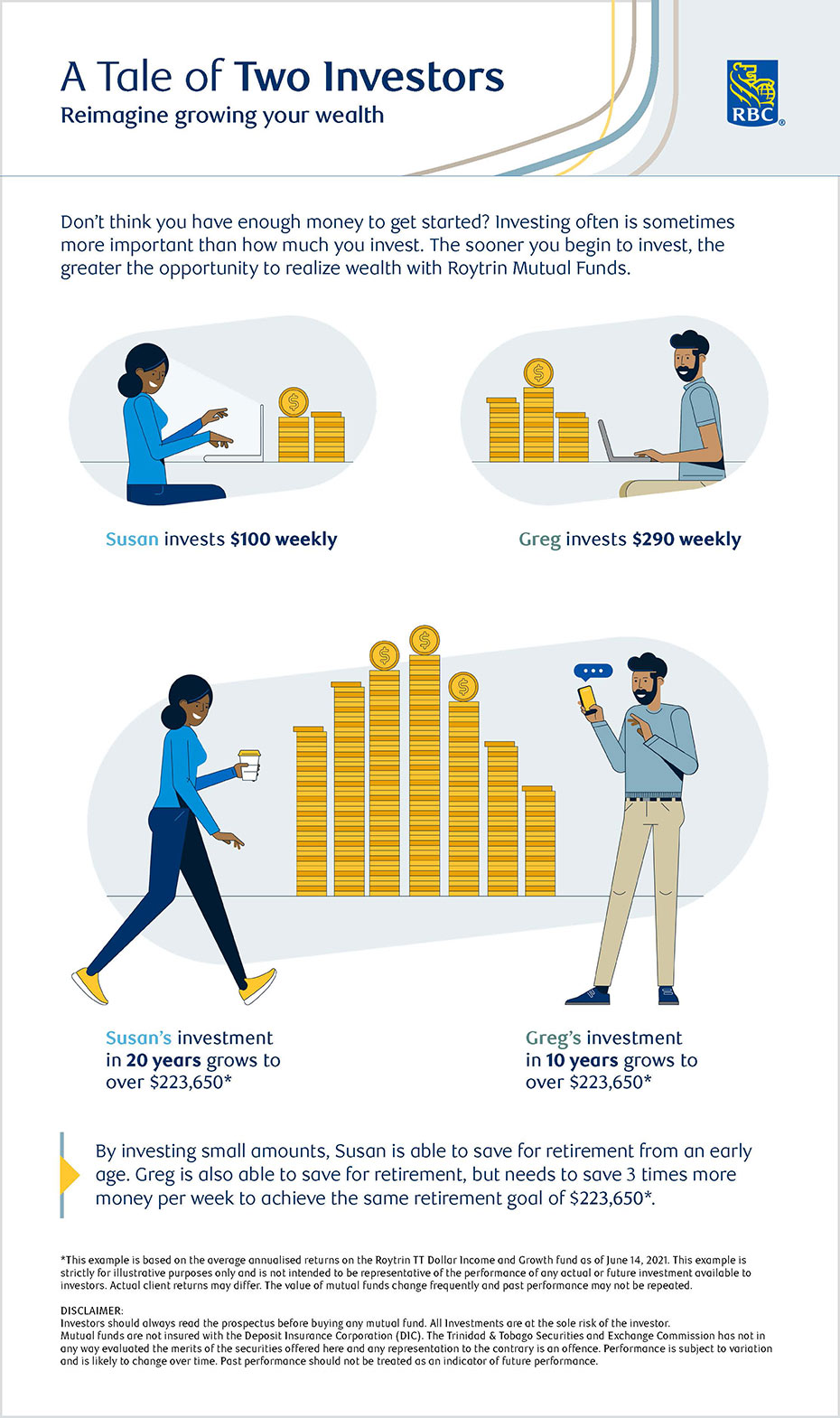

Reimagine Growing Your Wealth

Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and Some goals like a retirement goal is a culmination of all of one's life efforts Other goals such as meeting your child's higher education is a great example of how systematically Whatever your thinking might be, clearly articulating your objectives is an important step in devising a goalbased investment strategy that can withstand shortterm volatility While

Goal Based Investing Gbi E A Construcao Do Portfolio De Investimentos L Amour Investimentos

The Logical Tangent Tlt Presents Insta Learning Series Our Aim Is To Provide Online Education Anywhere And Everywhere So Why Not Social Media We Gonna Upload A Post On

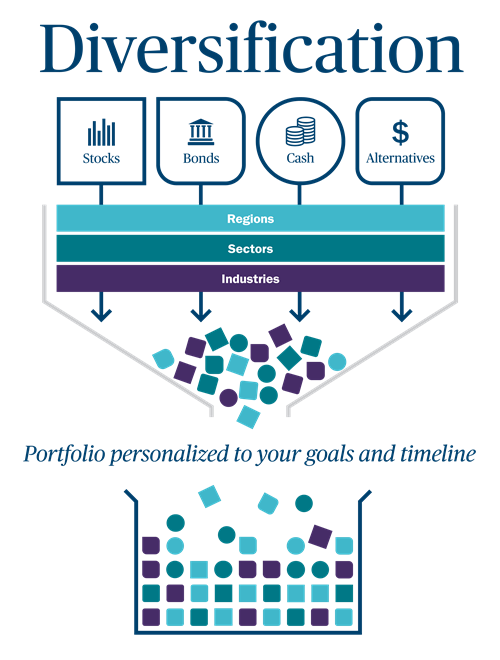

For example ️ If your Goal Based Investing In Mutual Funds When you invest in mutual funds, your funds are collected and then invested by mutual fund managers (experts) in different stocks Goalsbased investing works because your investments are constantly aligned with your goals and priorities By continually using the information in your goals and priorities toWhile some of your financial goals are current for example rent, food, transportation, many of your other financial goals occur in the future for example retirement, a child's education, buying a

Q Tbn And9gcr1eroddi Kqdd0bj0cgerymmcgw07hz Mhtmuwqpww508s8bk3mij Usqp Cau

How To Set Investment Goals The Motley Fool

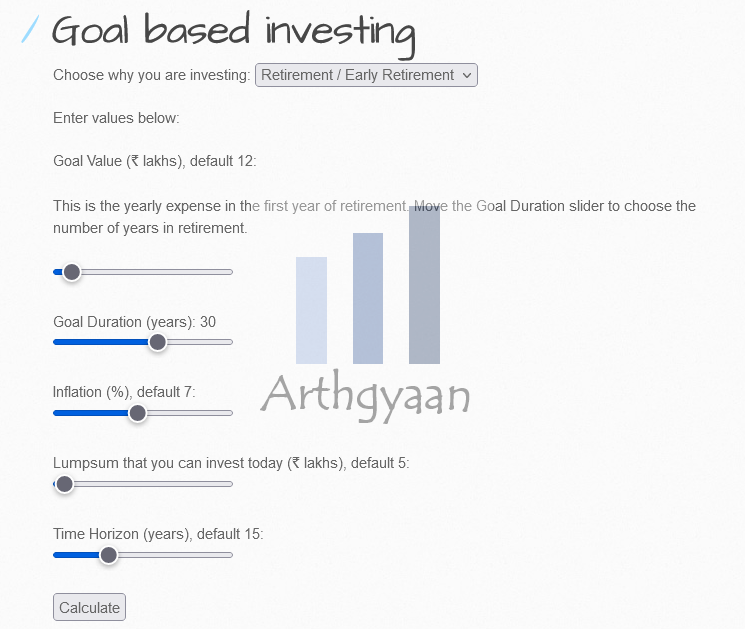

For example, you may need 15years of goalbased investment for buying a new house, whereas, for vacation planning, 12years of investing might suffice Take inflation into account So, what is GoalBased Investing (GBI)?The Value Add Our simple example highlights three practical implications of goalsbased investing First, investors and their advisors should view risk not just as annual volatility, but

Goal Based Investment Planning Retirement Planning Example And Video

10 Best Low Risk Investments In October 22 Bankrate

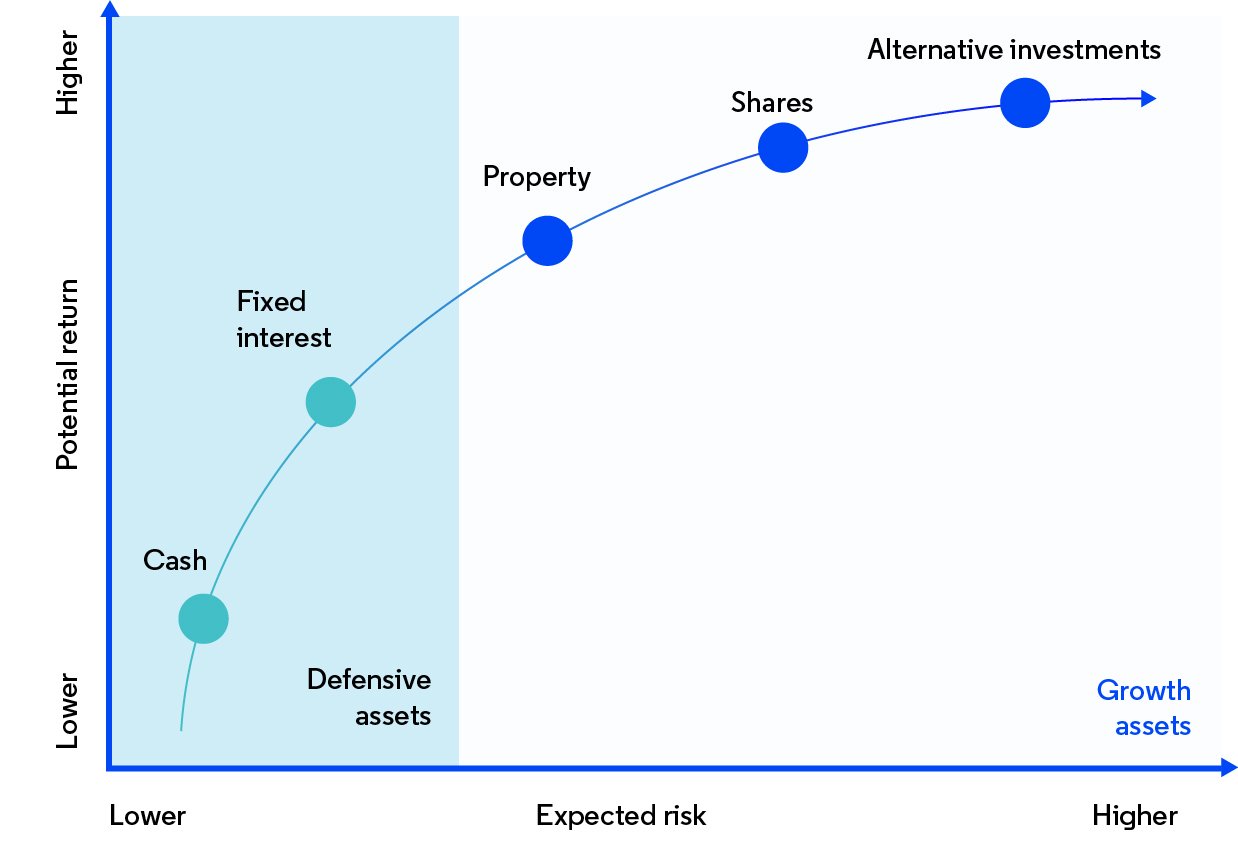

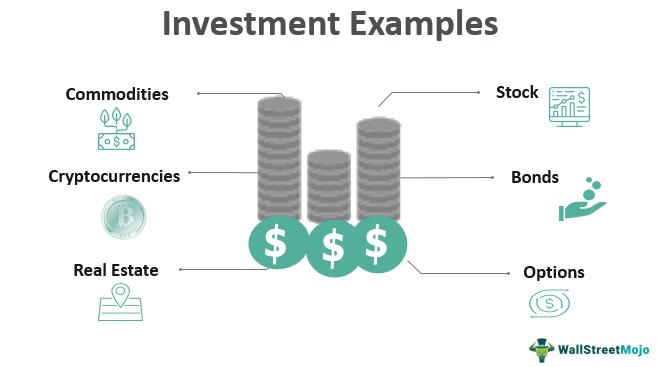

Risk simply materializes when assets are insufficient to meet the goals, resulting in a shortfall An obvious but painful and unfortunately rather common example is retirement risk,GoalsBased Investing or GoalDriven Investing is the use of financial markets to fund goals within a specified period of time Traditional portfolio construction balances expected portfolio variance Goalsbased investing is a simple approach in wealth management that implements dedicated investment solutions with the objective to achieve the highest possible probability of

2

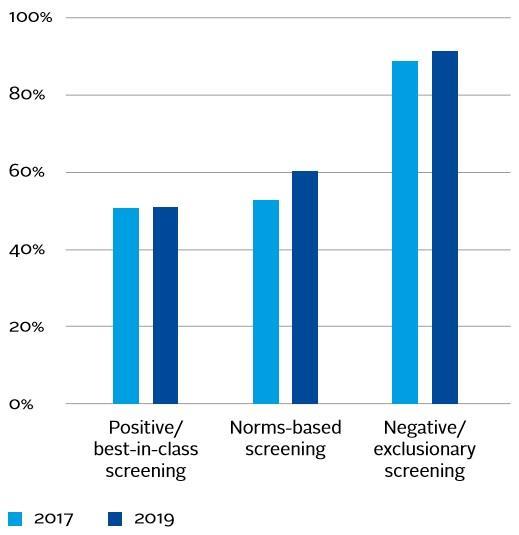

An Introduction To Responsible Investment Screening Introductory Guide Pri

Investing regularly to be able to reach the respective short, medium, long term financial goals is called goalbased investing For example, if you plan to purchase a vehicle in For example, if children's education costs Rs 10 lakh today, at 6% inflation, it would cost ₹1790 lakh in the next 10 years To ensure you accumulate this amount in the next 10 years,The guide to a practical way to map, advice and monitor clients goals Order Today 9 chapters, 195 pages Ronald Janssen MSc MFP (1970), managing director GoalsBased Planning, Ortec

Foundations Of Asset Management Goal Based Investing The Next Trend Pdf Free Download

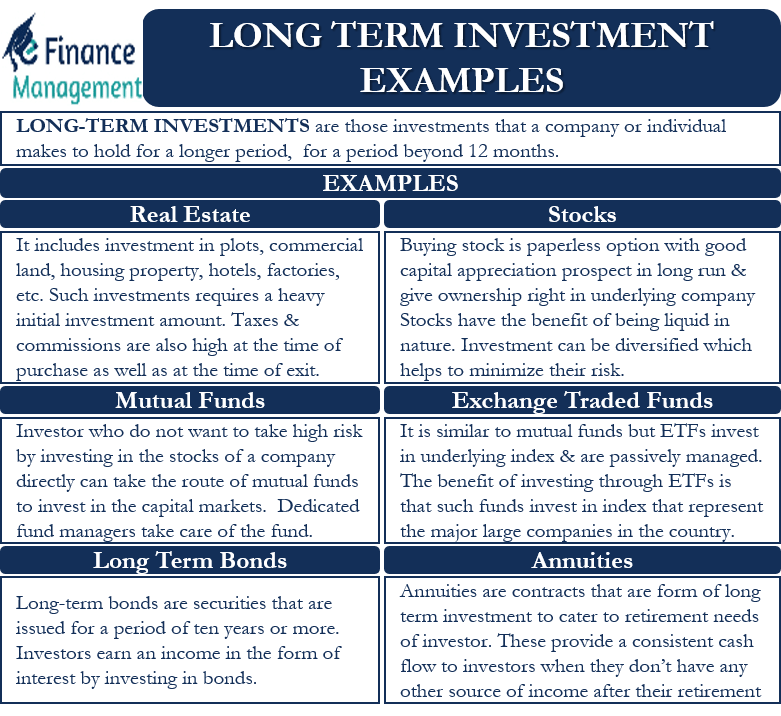

Long Term Investment Examples Meaning Examples With Pros And Cons

Closing Thoughts Goalbased investing is a relatively new way to achieve personal needs by investing in a definite strategy It's a good alternative to traditional investing which When investing, every investor has an objective in mind Usually, this objective differs for each investor based on several factors These factors may include an investor's time horizon, Goalbased investing is an investment strategy that uses financial instruments such as stocks, fixed deposits, mutual funds, public provident funds, real estate, etc, to work towards

3 Strategies To Help Reduce Investment Risk Ameriprise Financial

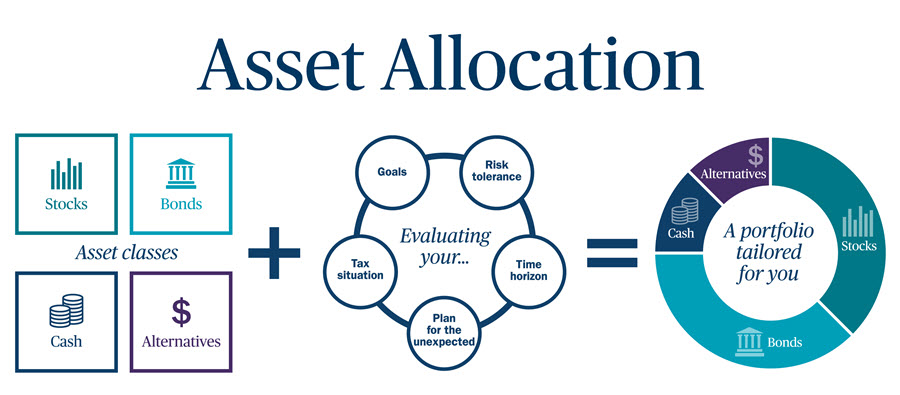

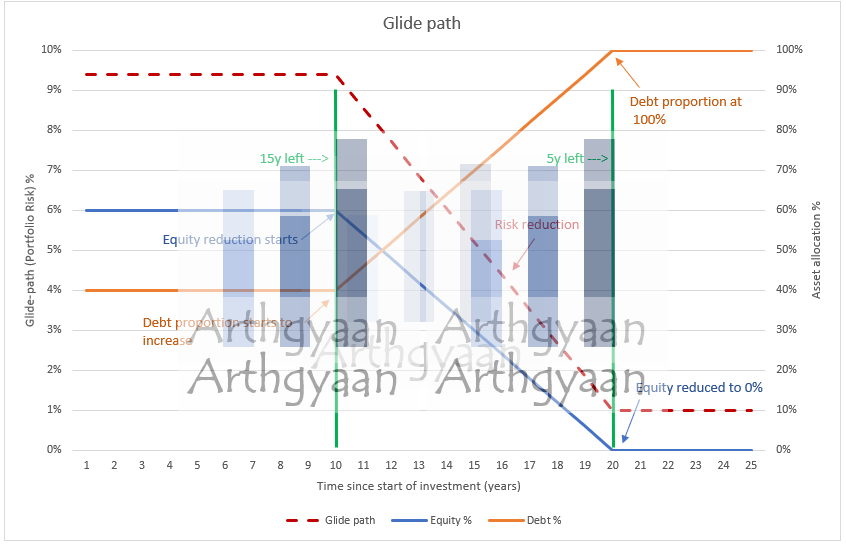

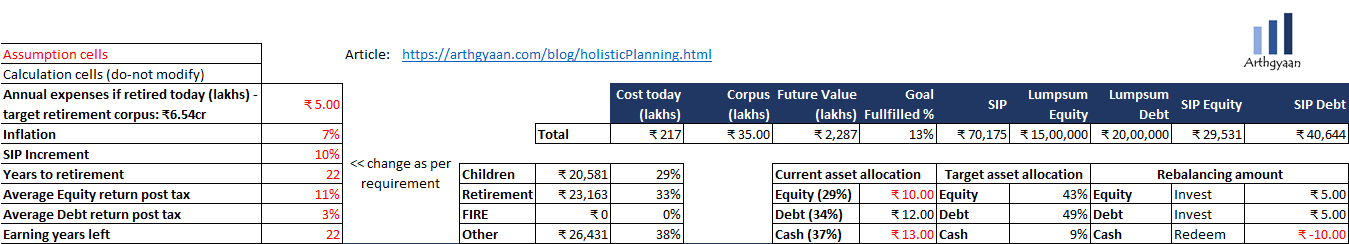

What Should Be The Asset Allocation For Your Goals Arthgyaan

Example of goalbased investing Source Endowus This chart illustrates the scenario of someone who plans to start investing $1,000, followed by an additional $500 each month He intends to We will consider a new goal, per year the loan is active, like this Cost of goal = 12 times (EMI Rent_Saved Tax Maintenance) TaxSavings Using the figures in the worked outGoalsbased investing an unwavering focus on the destination While MPT introduced a needed scientific discipline to the art of portfolio For example, a retirement income goal may be set

/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Investment Pyramid

Wmcp Wealth Management Certified Professional The American College

Every individual has life goals that he needs to reach in the short term or long term Calculating and investing regularly to be able to reach that financial goal is called goalbasedTo understand how goal based investing Other goals such as meeting your child's higher education is a great example of how systematically investing can help realize your and your child's dream A goal is a practical

Goals Based Investing Why It Matters To You And Your Business

How To Set Financial Goals Ramsey

Goalbased investing is a modern approach that focuses on helping investors attain specific financial goals Here's what you need to know to start your own goalbased investing strategy A3 The benefit of goalbased investing is that it allows you to make decisions based on solid evidence When you factor in predicted returns on equity, volatility, and inflationStart saving early Learn how to save money first;

Goal Based Investing Youtube

Four Types Of Esg Strategies For Investors Advisor Channel

Examples of GoalBased Investing To help you better understand goalbased investing, here are three common goals that you may have Shortterm goal Buying a home Some examples of goal based investing include Saving for your child's education Keeping money for retirement, Saving to purchase a house

Cdn2 Hubspot Net

Please Read This Before Buying A Lic Policy

10 Best Index Funds In October 22 Bankrate

What Kind Of Product Roadmap Is Right For Your Team Appcues Blog

/top-investing-strategies-2466844-FINALV1-0bf945be626a4c9b97bb9ebd6703d8cb.jpg)

Best Investment Strategies

Goal Based Investing How To Fund Your Goals

Complete Guide To Goal Based Investing Elementum Money

Morgan Stanley Goals Planning System Morgan Stanley

What Are Performance Goals Definition Examples Video Lesson Transcript Study Com

Every Individual Has Financial Goals That He Needs To Reach In The Short Medium Or Long Term Period Investing Regularly To Be Able To Reach The Respective Financial Goal Is Called Goal Based

Four Types Of Esg Strategies For Investors Advisor Channel

How To Invest A Step By Step Guide For Beginners

How To Set Financial Goals 6 Simple Steps

Goal Based Investing And Why It Matters

What You Need To Know About Impact Investing The Giin

Investing Goals Achieving Your Objectives Morgan Stanley

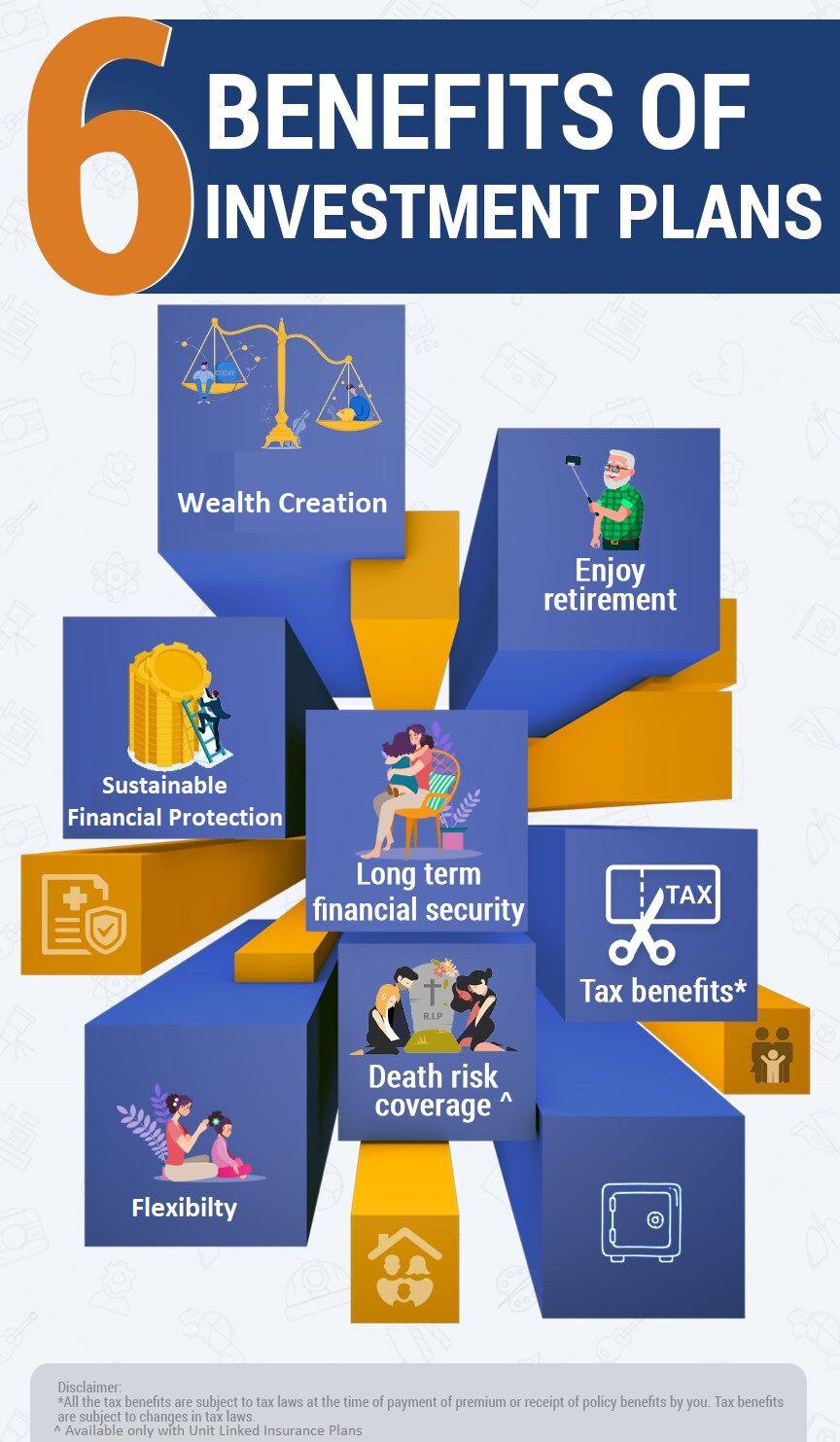

Wealth Creation Meaning Importance And Investment Plans

Goal Based Investing Plan For Your Daughter S Education Unovest

Retirement Investing Edhec Risk Institute

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Investment Strategies Definition Top 7 Types Of Investment Strategies

Develop An Investing Plan Moneysmart Gov Au

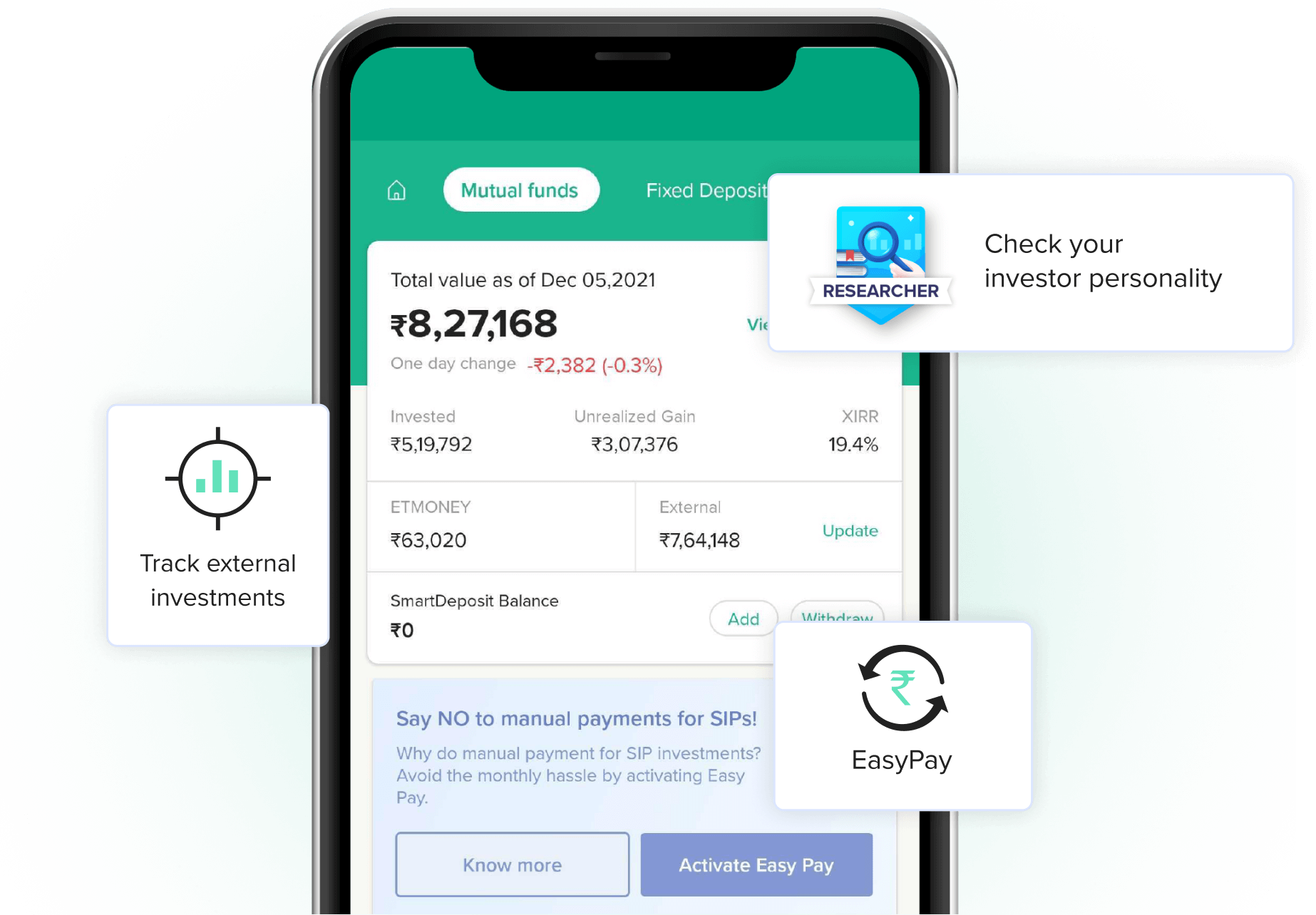

I Have 5 Lakhs In The Bank What Do I Do Now To Get The Best Returns Arthgyaan

What Kind Of Product Roadmap Is Right For Your Team Appcues Blog

Scycxndpgw Zmm

Sdg 17 Partnerships For The Goals Statistics Explained

3 Strategies To Help Reduce Investment Risk Ameriprise Financial

Financinglife Youtube

Stashaway What Are Some Of Your Long Term Financial Goals Tell Us In The Comments Below Learn More About Goal Based Investing Bit Ly 3skimag Facebook

Best Investment In Uae 22 Low Risk High Return

Q Tbn And9gcrsegpxhlmjvz5tzuanm66pt2bx7f1ijwu7lnjzmriikc7b0k4nm9do Usqp Cau

Goals Based Investing And Advice J P Morgan Private Bank

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

Set A Goal Before Looking For What To Invest In Arthgyaan

What Is A Share Shares Definition Canstar

Examples Of Financial Goals Clever Girl Finance

Investment Meaning Types Objectives Max Life Insurance

Smart Goals Finvestik

:max_bytes(150000):strip_icc()/DCF-V1-ed6022abf1344f7dbbe9926c6ca6c892.png)

Qba9 16q4uqpnm

Investing What Does It Mean How Does It Work

Mutual Funds Invest In Mutual Fund Online In India

/FourStepstoBuildingaProfitablePortfolio-171c087dc41f40269547e95a0b60eab5.png)

4 Steps To Building A Profitable Portfolio

2

What Kind Of Product Roadmap Is Right For Your Team Appcues Blog

How To Set Short Term Financial Goals With Smart Examples Self Credit Builder

How To Set Short Term Financial Goals With Smart Examples Self Credit Builder

/GettyImages-672149983-8d68b56735064d2eae5f813fafe9aae0.jpg)

Goal Based Investing

Long Term Financial Goals How To Plan Your Financial Future At Any Age Mintlife Blog

Balanced Advantage Funds Know What Is The Benefit Of Tax In Balanced Advantage Fund

3 01 Securities Exchange Commission Zambia

Investing Goals Achieving Your Objectives Morgan Stanley

Investing Principles Charles Schwab

Ulip Buy Unit Linked Insurance Plans Online In 22 Icici Prulife

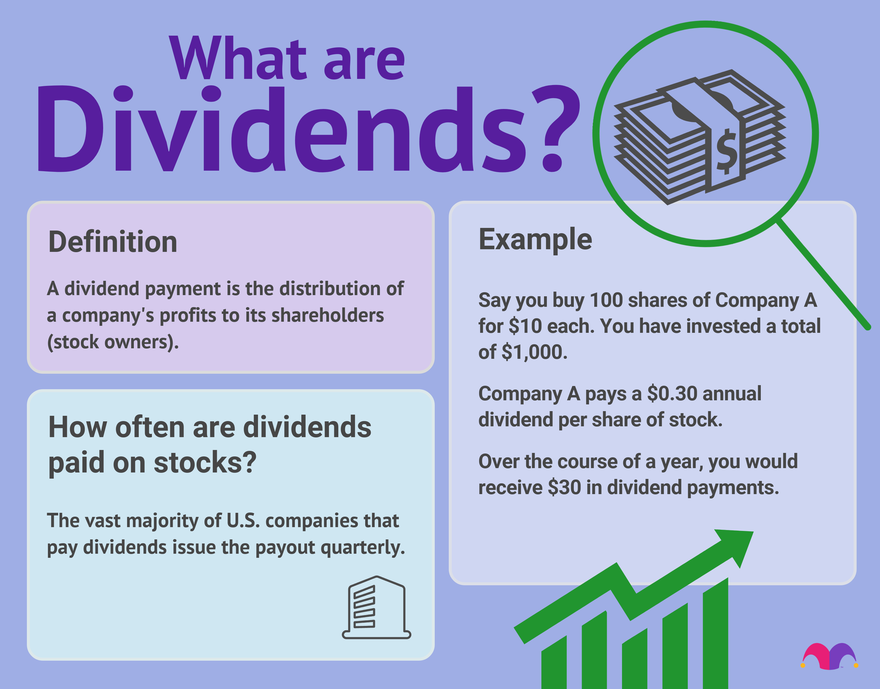

Dividend Investing How It Works And How To Get Started The Motley Fool

Q Tbn And9gcqacefstrekdb9bgy0gt4dz 6y4cbmgctasc D2emspbpsk1y7dvb Usqp Cau

Investing Like It Should Be Stashaway Vavai S Personal Notes

Advance Your Financial Goals With The Best Investment In The Philippines

Vanguard Digital Advisor Vanguard

10 Best Long Term Investments In October 22 Bankrate

/Investment_final-855f6b81c11f4634b2417a3e747628e8.png)

Investment Basics Explained With Types To Invest In

What Should Be My Mix Of Mf Stocks Gold Nps Fd Ppf And Elss If I Want To Invest 50k Per Month Arthgyaan

Your Investment Plan Vanguard

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

Foundations Of Asset Management Goal Based Investing The Next Trend Pdf Free Download

How To Set Financial Goals Ramsey

Online Investing At Ellevest

Invesco Mutual Fund Home Facebook

What Kind Of Product Roadmap Is Right For Your Team Appcues Blog

What You Need To Know About Impact Investing The Giin

Risk Tolerance And Time Horizon Fidelity

Financial Goals Definition Examples Short Long Term Goals

Money Musingz Personal Finance Blog Goal Based Financial Investing

How Much Money Do I Need To Start Investing Nextadvisor With Time

Wealth Creation Meaning Importance And Investment Plans

Short Term Savings Goals A House A Wedding A Car Vanguard

Investment Examples Top 6 Types Of Investments With Examples

Tiaainstitute Org

Advantages And Benefits Of Investing In Mutual Funds In India

Q Tbn And9gcrkd81krlpxsbpc79cm30boccllt6ibjsygzzgikoa2mi0p810mn Usqp Cau

Goal Investment Plans Decide The Asset Class With Your Financial Advisor That Suits You Work Backwards And Calculate The Amount You Could Invest Through Sip Or A Lumpsum Or A Combination Of

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Long Term Financial Goals How To Plan Your Financial Future At Any Age Mintlife Blog

Robo Advisor Investment Portfolios Openbank Wealth

Rank Mf Goal Based Investing Is A Powerful Method That Facebook